At least for dividends, there doesn’t seem to be any love in the headlines. From CNBC at the first of the year they wrote, “Market’s Flat 2011 Could Imply Rally This Year. Following last year’s pancake-flat finish on the S&P 500…” And there were many others like this. If you didn’t investigate further you probably wouldn’t even realize that the S&P 500 was up last year. The S&P finished positive 2.1% on a total return basis.

At least for dividends, there doesn’t seem to be any love in the headlines. From CNBC at the first of the year they wrote, “Market’s Flat 2011 Could Imply Rally This Year. Following last year’s pancake-flat finish on the S&P 500…” And there were many others like this. If you didn’t investigate further you probably wouldn’t even realize that the S&P 500 was up last year. The S&P finished positive 2.1% on a total return basis.

How, you may ask, did this happen?

Many of the stocks in the S&P 500 index pay dividends. The total yield on the S&P 500 was 2.3% as of 12/31/11 and these are payments made directly to the shareholder in cash, or one can choose to reinvest them. This must also be counted in your return, but many seem to overlook this fact.

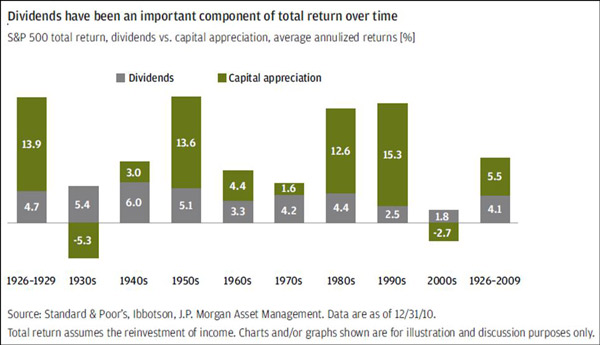

Dividends can provide a potential source of income to help cushion portfolios in down markets and potentially bolster returns during up markets.

While 2% may seem like a pittance compared to fluctuations in stock values, between 1926 and 2009 these small payouts have generated about 40% of overall return in the S&P 500 (WSJ, A Time for Dividends, 10/5/11) and can be vital to achieving long term financial planning goals.

* Investor’s cannot invest directly in an index. Past performance is not indicative of future results.The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Dividends are not guaranteed and must be declared by a company’s board of directors.

* Investor’s cannot invest directly in an index. Past performance is not indicative of future results.The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Dividends are not guaranteed and must be declared by a company’s board of directors.