The Center’s High Income/High Net Worth practice group is a specialized team dedicated to serving the unique financial needs of affluent individuals and families. Our group combines tailored planning and a comprehensive approach to help clients achieve their complex financial and estate goals while navigating the opportunities and challenges that come with stewarding substantial wealth (typically starting at accumulated investment and business assets in excess of $10 million). Our primary objective is to effectively manage, grow, and preserve the wealth of our clients, while also addressing their uniquely intricate circumstances such as generational wealth transfer and philanthropic endeavors. The advisors in this group possess in-depth knowledge of sophisticated financial strategies, investment vehicles, tax optimization, estate tax reduction, and other complex financial matters relevant to high income and high net worth clients. Our time proven process aims to ensure that all aspects of our client’s financial life are seamlessly integrated and optimized by collaborating with other key professionals as needed. Services and offerings include:

Tax minimization strategies (tax harvesting, appreciated securities, income, estate, gift, and generation-skipping transfer tax minimization)

Investment management solutions (including alternative investments, tax-managed strategies such as direct indexing, tailored bond portfolios)

Estate and charitable planning (strategies for tax-efficient wealth transfer to next generation, donor advised funds and private foundations)

Lending* and cash management (securities-based lending, intrafamily loans, money market and cash management solutions)

Intergenerational wealth strategies (various estate-planning vehicles, gifting programs, longevity planning)

Risk mitigation and management (goal planning and scenario analysis, insurance offerings, concentrated equity strategies, portfolio diversification)

Taxes and Municipal Bonds....the bottom line. August 2025

Here are a few thoughts on the new tax legislation, OBBBA for short, and how it may impact your financial planning. Additionally, we’ve included a brief commentary on municipal bonds – an asset class that high income folks do and should consider using.

TAX BRACKETS

No change to tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%

ITEMIZED DEDUCTION LIMITATION (2026)

A new cap reduces itemized deductions for those in the 37% marginal bracket (taxable income for single filers $626k and married filing jointly $751k).

The bottom line is that deductions are reduced to a maximum of 35% instead of your 37% marginal bracket.

This change may make it beneficial to accelerate or "bunch" charitable contributions into 2025. For instance, using a Donor Advised Fund (DAF) can be an effective strategy. As a reminder, contributions of appreciated securities to a DAF are generally deductible up to 30% of your Adjusted Gross Income (AGI). This is the preferred method as capital gains are also avoided.

ITEMIZED DEDUCTION - CHARITABLE GIFTING (2026)

There is a new 0.5% of AGI floor on charitable contributions. For example, if AGI is $500k, then the first $2,500 in contributions is non deductible.

Add this new provision to the limitation provision above, even a stronger argument to consider additional charitable contributions in 2025.

ITEMIZED DEDUCTION - SALT DEDUCTION (2025)

The State & Local Tax (SALT) deduction cap is raised to $40k from $10k starting this year (2025).

Higher income folks may not see any change. Surprisingly for both single or married filing jointly, those with MAGI over $500k (think adjusted gross income with a few add backs) – the deduction phases out by 30% above the excess income….but you still get at least the minimum $10k deduction. The bottom line, if MAGI is over $600k, then you will receive the same $10k itemized deduction.

ESTATE TAX EXEMPTION (2026)

“Permanent” increased (law can always be changed by future legislation) to $15M per individual and $30M per married couple in 2026 with future inflation adjustments ($13.99M/$27.98M in 2025). The bottom line, those who are using up their estate tax exemption during life have an opportunity to transfer additional assets outside the estate.

GST (generating skipping tax) exemption is the same amount as above.

The 40% tax rate on amounts above the exclusion remains unchanged.

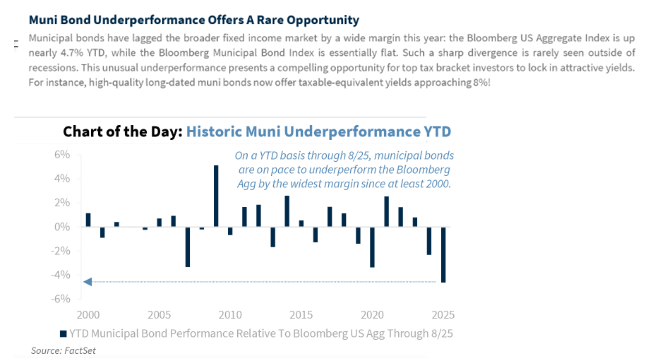

MUNICIPAL BONDS

Bottom line, they have underperformed taxable bonds this year. Despite recent underperformance, municipal bonds remain compelling for high income earners due to their tax-equivalent yields and exemption from federal income tax.

* Lending Services and Securities Based Line of Credit provided by Raymond James Bank, member FDIC, affiliated with Raymond James Financial Services and Raymond James & Associates, Inc.

The bond indexes mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.

Investments in municipal securities may not be appropriate for all investors, particularly those who do not stand to benefit from the tax status of the investment. Municipal securities typically provide a lower yield than comparably rated taxable investments in consideration of their tax-advantaged status. Municipal bond interest is not subject to federal income tax but may be subject to AMT, state or local taxes. Please consult an income tax professional to assess the impact of holding such securities on your tax liability.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of Raymond James, we do not provide tax or legal advice. You should discuss tax or legal matters with the appropriate professional.

Raymond James and its advisors do not provide tax advice.