Contributed by: Sandra Adams, CFP®

Contributed by: Sandra Adams, CFP®

The older I get, the more I realize that we should expect the unexpected. As I work with clients in the prime of their retirement planning years who are suddenly experiencing life events that weren’t “part of the plan,” this resonates more than ever.

What kinds of things am I talking about? How about a young pre-retiree who experiences a terminal illness or becomes a caregiver for a spouse or family member? Or someone who experiences the loss of a spouse, experiences divorce after a very long marriage, but before retirement? Or even someone who, only a few short years before their planned retirement, suddenly loses their long-time job due to a layoff?

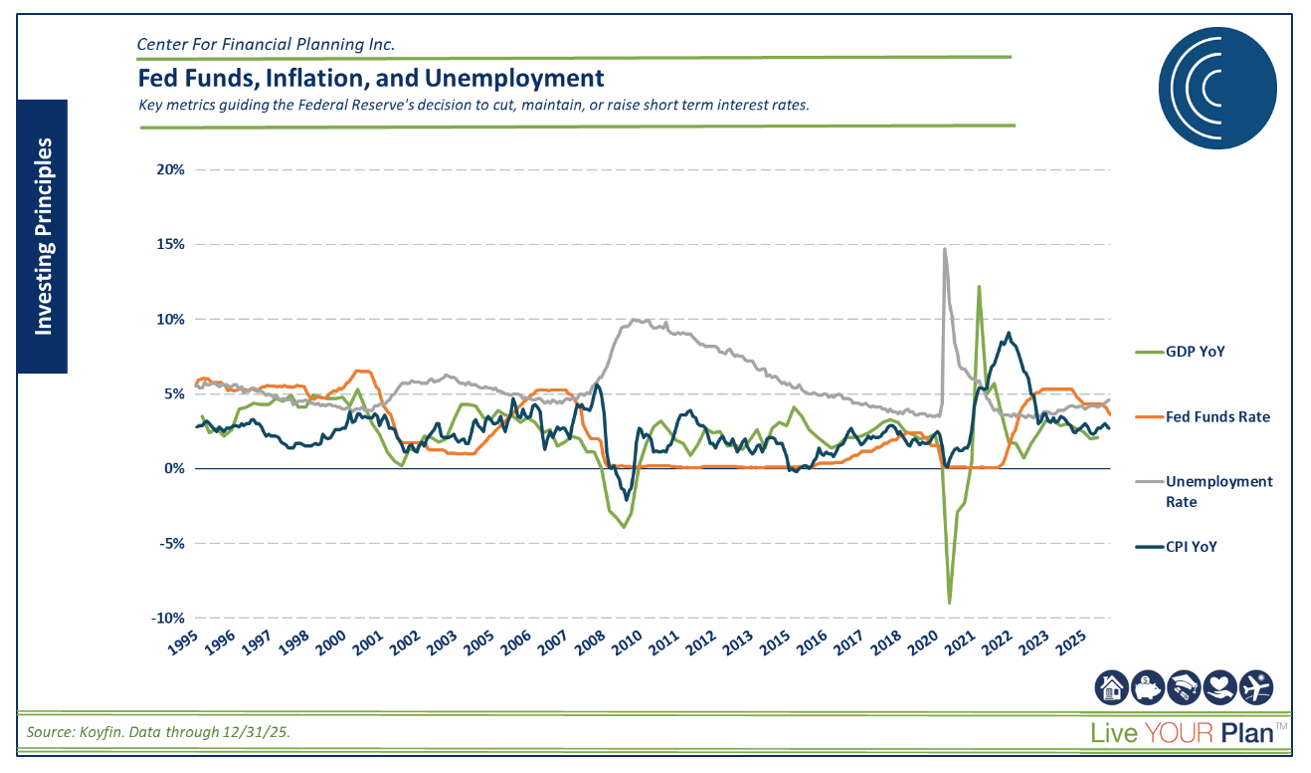

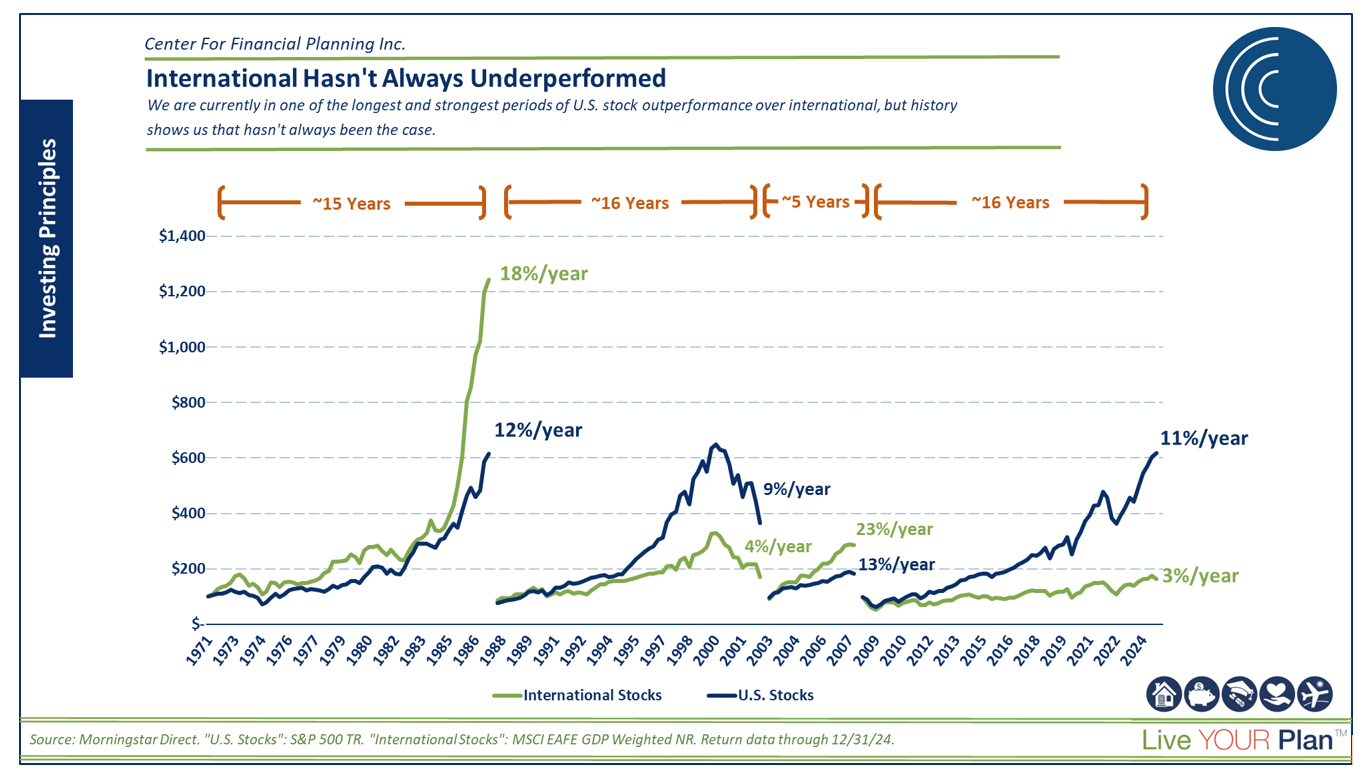

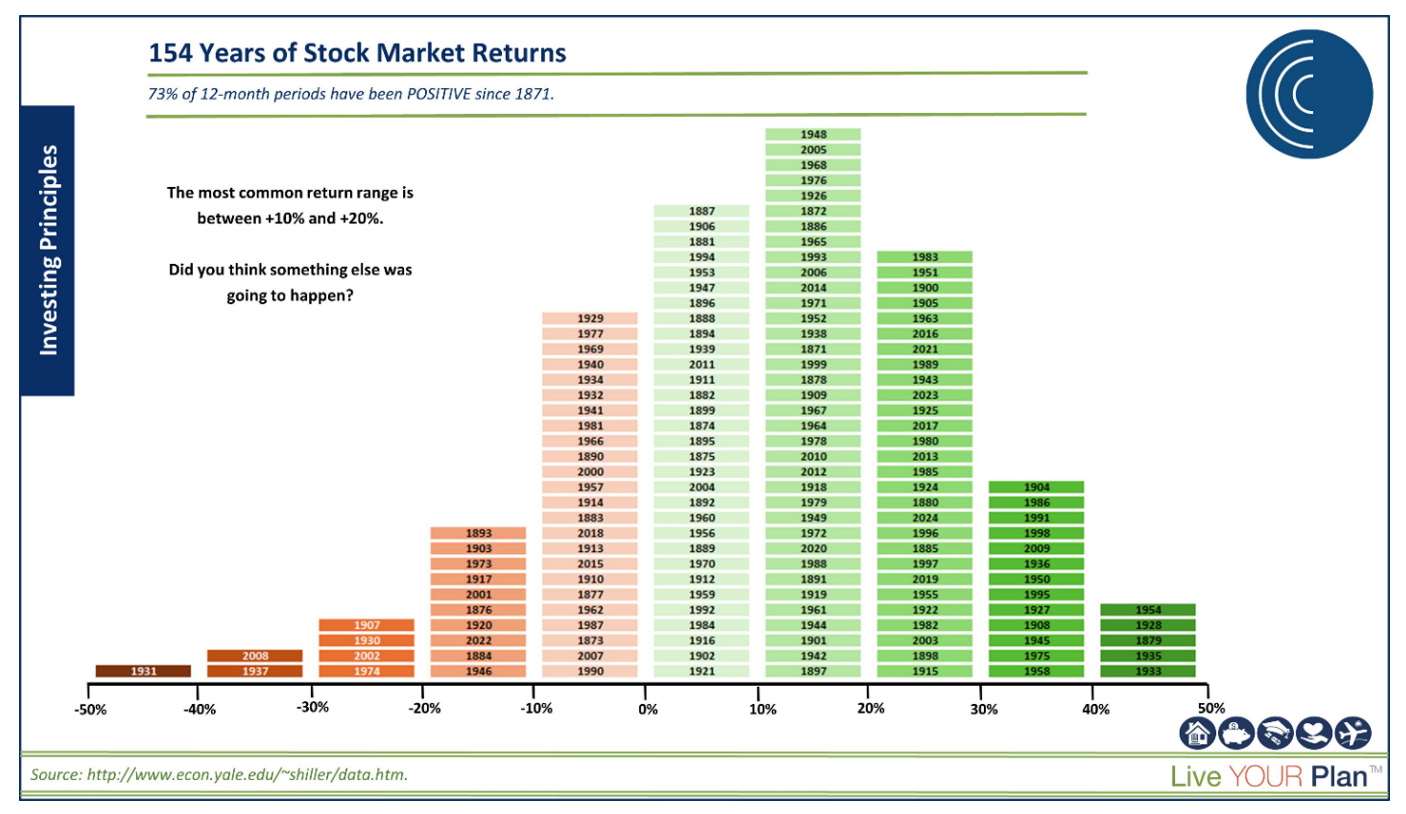

Losing a job is just one of many unexpected, pre-retirement events that can potentially throw savings goals and plans off course. Some may add that a prolonged or very negative stock market decline can also hinder retirement and, in most cases, be unexpected. As the old saying goes, you should always “expect the unexpected”.

What can you or should you do now to make sure that you can keep your retirement strategy on track, even if one of these unexpected events sneaks into your life?

Plan Early and Update Often. Although many folks don’t like to think about it, start digging into how much income you will need in retirement. If your income projection is significantly less than what you are bringing home now, what will change in retirement to make you need less income? Will you have significantly less debt? Will the activities you plan to do in retirement cost significantly less? Be realistic. Take stock regularly of where you are toward your savings goals versus your needs, so you stay on track and can update your strategy if you are not moving toward those goals.

Save, Save, and Then Save a Little More. When times are good, and while you can, stretch yourself to meet your savings goals. There is a delicate balance between spending to enjoy your life now and saving for your retirement. It makes sense to set significant retirement savings goals (especially if you didn’t start as early as you wanted to). And making it a habit to save more – even one percent each year – will help you reach or exceed your retirement savings goals. Other ways to get ahead can include allocating a portion of your annual raise or any bonus you might receive to retirement savings. Aim to save, save, and save a little more to put yourself in a position to absorb the unexpected.

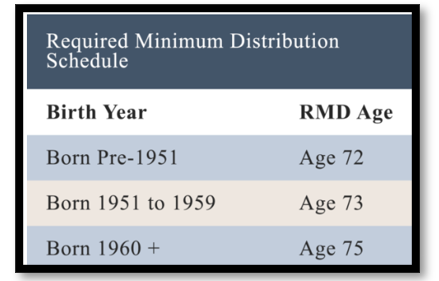

Take Control of What You Can Control. While you cannot control what happens to the markets, your job (for the most part), or your health (other than eating right and exercising), there are things you can control. You can control your savings rate: be disciplined about saving, save regularly, and continue saving more over time. You can save in the right places: You can attempt to max out your savings within your employer retirement savings plans on a tax-deferred basis, you can have a liquid cash emergency reserve fund of at least 3-6 months of expenses “in case” something unexpected comes up, and you can have an after-tax investment account and/or ROTH IRA (if your income tax bracket allows) in case a life event causes an earlier-than-expected retirement or a temporary unemployment situation. You can keep debt under control and plan to have as much debt paid off as possible going into retirement. Reducing fixed costs during retirement allows you to use your cash flow for wants versus needs, and provides you with greater flexibility if an unexpected event occurs.

Put Protections and Guardrails in Place. Planners like to call this “risk management”. We are talking about protection for contingencies, so they don’t sink your retirement ship. Having a reserve or emergency savings account is a good first step. But what else might you put in place? It’s important to have the right insurance – disability, life, and long-term care. Continuing education and networking are also important protections – WHAT? Keep up your credentials and training so that if your current job is phased out, you are prepared to jump back on the horse and get re-employed quickly. Many folks become complacent and, if something unexpected happens with their company or their role, are completely unprepared to seek new employment. Unfortunately, the U.S. Government Accountability Office estimates that older workers wait more than 40 weeks to become re-employed, so being prepared can make all of the difference.

Seek Good Advice. This is not a time to DIY. There are way too many things that can go wrong when it comes to a potential early retirement transition. Seeking the advice of a trained professional can help you find the best course of action. In most cases, assessing your specific situation and making the best possible decisions, especially when it comes to things like pensions, Social Security, and which accounts to tap for retirement income, can make a huge difference.

“The more things change, the more things stay the same” – Jean-Baptiste Alphonse Karr

When we do an initial financial plan for a client, we like to say that something will very likely change when the client walks out the door, and we will need to adjust the plan. Life happens. A financial plan must be fluid and flexible. And so must you, as someone who is planning for retirement. Unexpected events that happen just as you are reaching for the golden doorknob to retirement can be frustrating. But if you have expected the unexpected, planned for the contingencies, and have some spending flexibility built into your plan, you will be on your way to a long and successful retirement.

Sandra Adams, CFP®, is a Partner and CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® and holds a CeFT™ designation. She specializes in Elder Care Financial Planning and serves as a trusted source for national publications, including The Wall Street Journal, Research Magazine, and Journal of Financial Planning.

Opinions expressed in the attached article are those of Sandra D. Adams and are not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. 401(k) plans are long-term retirement savings vehicles. Withdrawal of pre-tax contributions and/or earnings will be subject to ordinary income tax, and if taken prior to age 59 ½, may be subject to a 10% federal tax penalty. Roth 401(k) plans are long-term retirement savings vehicles. Like Traditional IRAs, contributions limits apply to Roth IRAs. In addition, with a Roth IRA, your allowable contribution may be reduced or eliminated if your annual income exceeds certain limits. Contributions to a Roth IRA are never tax deductible, but if certain conditions are met, distributions will be completely income tax free. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.