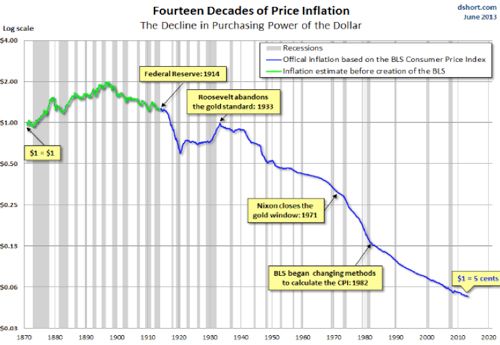

As a kid I fondly remember sitting around hearing stories from my parents’ childhoods. While I gave some stories more credence than others, there were many interesting lessons to learn if you could get past the obvious embellishments. For example, even at a young age, I recognized it was impossible to walk up hill all the way both ways to school if there was only one route to take. However, other stories show the power inflation can have on our buying power as is exhibited in the chart below. Perhaps Dad wasn’t embellishing when he said a candy bar only cost a nickel.

As a kid I fondly remember sitting around hearing stories from my parents’ childhoods. While I gave some stories more credence than others, there were many interesting lessons to learn if you could get past the obvious embellishments. For example, even at a young age, I recognized it was impossible to walk up hill all the way both ways to school if there was only one route to take. However, other stories show the power inflation can have on our buying power as is exhibited in the chart below. Perhaps Dad wasn’t embellishing when he said a candy bar only cost a nickel.

The chart shows that $1 today only purchases what a nickel would have purchased in 1871 and again in 1933! While inflation is quite low right now (1.4% as of the June 18th 2013 report by the Bureau of Labor Statistics) it likely won’t stay this way forever as history has shown. Inflation can have a devastating effect on retirement planning if your plan and asset allocation aren’t structured to handle it.

Someday, while my daughter may never believe I lived without an iPad (or whatever the advanced version is at that time), she will surely roll her eyes at the idea that a Starbucks latte cost less than $5 in 2013! So, while I suggest properly planning for inflation, you might also collect a little evidence in the here and now to back up your stories down the road.

Angela Palacios, CFP®is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well asinvestment updates at The Center.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material.