Finding yield has become a struggle for investors today. At the beginning of 2014, most experts were expecting the yield on U.S. 10-year Treasuries to end the year well above 3%. However, they ended up going down from where they started the year and finished at 2.2% (and are even lower today). Many were left scratching their heads as to why this could have happened. However, when you look at the high quality government bond options around the would you can start to understand why. It’s all relative.

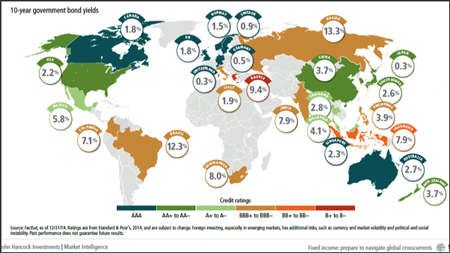

Mapping 10-year Government Bond Yields

First of all, not much of the world is considered “high quality”. The turquoise countries in the graphic below are the only countries that receive the coveted AAA rating. This includes Canada, Australia, Singapore and much of Europe. There are a few countries in the AA rating, or bright green color coding camp, which is where the United States falls.

Second, look at the yields these countries pay. Of the AA and AAA rated countries, U.S. Treasuries at 2.2% have the most attractive rates for the credit quality and also perceived quality by others. Would you want to buy 10-year Chinese government bonds for only 1.5% more yeild over the U.S. (3.7% versus 2.2%)? The answer is generally no with the bulk of your fixed income assets.

Many governements, institutions and pension funds agree. So U.S. bonds are aggressively bought when their rates go up, even a little, by institutions and governments because they are a safe haven with the best relative yields out there. This buying then drives the rates right back down again. The blue bars on the chart below show month-by-month how many trillions of U.S. Treasuries are owned by foreign governments. You can see as tapering occurred (indicated by the green boxes in $’s), the U.S. pulled back on the amount of bonds it was buying, then yields would spike (see the purple line) and foreign governments would buy.

Now, with Europe embarking on its own bond buying program, yield curves and thus rates in Europe are going to come down even further. This is likely to make this phenomena even more pronounced. For at least the near term, it is likely we will be stuck with lower rates here in the U.S. and around the world as these trends persist.

Angela Palacios, CFP®is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well asinvestment updates at The Center.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of [insert FA name] and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. There are special risks associated with investing in bonds (fixed income) such as interest rate risk, market risk, call risk, prepayment risk, credit risk, and reinvestment risk. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices generally rise. International investing involves special risks, including currency fluctuations, different financial accounting standards, and possible political and economic volatility. C15-003427