Investment Commentary: 3Q 2017

Contributed by: Angela Palacios, CFP®, AIF®

This summer came and went with no shortage of topics for investors to worry about. Low inflation, natural disasters, and geopolitical tension kept the headlines busy. Despite all of this, the quarter ended on a positive note. The uptick in markets was spurred on by a wide-spread pick up in global growth. Recession risks continue to remain muted as dovish global central banks continue to inject liquidity in the system, or only very slowly begin to pull back on the injections. In general, economic data remains strong. We remain watchful for a slowing, particularly in manufacturing, business and consumer confidence, as these are early indicators of the tide of the economy turning. However, they are still positive.

Diversification is coming back into style as international and emerging markets continue to perform stronger than their domestic counterparts this year. The S&P 500 Index ended the quarter returning 14.24% through the 30th of September. International markets are truly the bright spot with the MSCI EAFE returning 19.96% and the MSCI EM Index returning 27.78%. Bonds ended the third quarter with a respectful 3.14% return coming from the Barclays US Aggregate Bond Index.

Rates remain unchanged

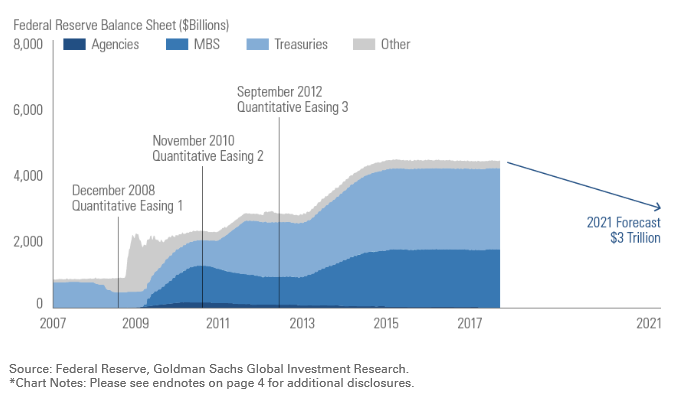

In September, the Federal Reserve (Fed) kept rates unchanged, but also announced additional information on how it will begin to unwind the $4.5 trillion balance sheet in October.

The Committee intends to gradually reduce the Federal Reserve's holdings of treasury securities and agency securities--agency debt and agency mortgage-backed securities (MBS)--by decreasing the reinvestment of the principal payments it receives from securities holdings. Each month, such payments will be reinvested only to the extent that they exceed a pre-specified cap. The caps will rise gradually at three-month intervals over a 12-month period and the maximum value of the caps at the end of the 12-month period will be maintained until the size of the balance sheet is normalized. (https://www.federalreserve.gov/monetarypolicy/policy-normalization-qa.htm)

This plan to shrink the balance sheet seems to reflect the Fed’s positive view of the U.S. economy.

Proposed tax changes being debated

Political stakes are high for President Trump to score a legislative win on what remains of his campaign promises. In late September, he unveiled a proposal to slash taxes for individuals and businesses. To simplify the tax code, Republicans have proposed condensing from seven tax brackets down to three (12%, 25% and 35%), doubling the standard deduction to help tax payers eliminate the need to itemize, and “significantly increasing” the child tax credit while also adding a new tax credit for the care of non-child dependents (elder-care situations).

Currently, many taxpayers use itemized deductions, claiming write-offs for things like charitable contributions, interest paid on a mortgage, state and local taxes. If the standard deduction becomes larger, fewer taxpayers will need to itemize, reducing the incentive to hold a mortgage or contribute to charity.

President Trump is also proposing to cut the corporate tax rate from 35% down to 20%. A new tax rate would be established for pass-through entities which represent about 95% of businesses in the United States. Generally when corporate tax rates are cut, markets perform very well in the year following the tax cut. The chart below demonstrates that after the rate cut for corporate taxes (Orange area below the line), the following 1 year returns on the S&P500 are quite positive (blue bar above the line).

Michigan 529 plan changes

In September, the Michigan 529 Advisor Plan, transitioned its program from Allianz Global Investors to Nuveen Securities, LLC. Account numbers stayed the same and investments mapped over to similar strategies; if you had one of these accounts, the transition was seamless. Some of the benefits of the change include an expanded investment line-up, more leading edge investment managers and lower fees. If you have any questions don’t hesitate to reach out!

After several years of equity volatility near historic lows, this quarter we again experienced the speed and scale at which geopolitics can possibly move markets. We remain committed to the view that managing volatility is at the heart of proper portfolio design. It is a responsibility we take very seriously and we thank you for the continued trust you place in us to help you with these decisions!

On behalf of everyone here at The Center,

Angela Palacios, CFP®, AIF®

Director of Investments

Financial Advisor

Investment Pulse: Check out Investment Pulse, by Nick Boguth, a summary of investment-focused meetings for the quarter.

Investor Ph.D Series: How Currency Movement Effect International Investments

Investor Basics Series: Nick Boguth, Investment Research Associate, talks about exchange rates.

Of Financial Note: Jaclyn Jackson, Portfolio Coordinator, shares a look at the asset flow for 3rd quarter.

Angela Palacios, CFP®, AIF® is the Director of Investments at Center for Financial Planning, Inc.® Angela specializes in Investment and Macro economic research. She is a frequent contributor The Center blog.

This information does not purport to be a complete description of the securities, markets, or developments referred to in this material; it has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Any opinions are those of Angela Palacios and are not necessarily those of Raymond James. This information is not a complete summary or statement of all available data necessary for making and investment decision and does not constitute a recommendation. Investing involves risk; investors may incur a profit or loss regardless of the strategy or strategies employed. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets. Asset allocation and diversification do not ensure a profit or guarantee against loss. Past performance is not a guarantee of future results. The MSCI EAFE (Europe, Australasia, and Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 21 developed nations. The MSCI Emerging Markets is designed to measure equity market performance in 25 emerging market indices. The index's three largest industries are materials, energy, and banks. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Barclays Capital US Aggregate Index is an unmanaged market value weighted performance benchmark for investment-grade fixed rate debt issues, including government, corporate, asset backed, mortgage backed securities with a maturity of at least 1 year. Please note direct investment in any index is not possible. Index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary.