Tax Reform Series: Changes to Charitable Giving and Deductions

Contributed by: Nick Defenthaler, CFP®

The Tax Cuts and Jobs Act (TCJA) is now officially law. We at The Center have written a series of blogs addressing some of the most notable changes resulting from this new legislation. Our goal is to be a resource to help you understand these changes and interpret how they may affect your own financial and tax planning efforts.

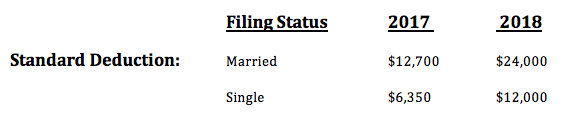

If you’ve heard the charitable deduction is going away under the Tax Cuts and Jobs Act of 2017, you are certainly not alone – this is a common misconception under our new tax code. To be perfectly clear, gifts to charity are certainly still deductible! However, depending on your own tax situation; your deduction may not provide any tax savings due to the dramatic increase in the standard deduction moving into 2018:

Standard Deduction vs. Itemizing Deductions

Think of the standard deduction as the “freebie deduction” that our tax code provides us, regardless of our situation. If you add up all of your eligible deductions (state and local tax, property tax, charitable donations, medical expenses, etc.) and the total happens to exceed the standard deduction, you itemize. If they fall short, then you take the standard deduction. Pretty simple, right?

With the standard deduction nearly doubling in size this year, many of us who have previously itemized deductions will no longer do so. Let’s take a look at how this change could impact the tax benefit of your charitable donations:

Example

Below is a summary of Mark and Tina’s 2017 itemized deductions*:

State and Local Taxes = $6,600

Property Tax = $6,000

Charitable Donations = $5,000

Total = $17,600

Because the standard deduction was only $12,700 for married filers in 2017, Mark and Tina itemized their deductions. However, the only reason why they were able to itemize was due to the $5,000 gift they made to charity. If they didn’t proceed with their donation, they simply would have taken the standard deduction because their state and local tax along with property tax ended up being only $12,600 – $100 shy of standard deduction for 2017 ($12,700). Their gift to charity created a tax savings for them because it went above and beyond the amount they would have received from the standard deduction!

For the sake of our example, let’s assume Mark and Tina had the same exact deductions in 2018. It will now make more sense for them to take the much larger standard deduction of $24,000 because it exceeds the total of their itemized deductions by $6,400 ($24,000 – $17,600). In this case, because they are taking the standard deduction, there was no direct “economic benefit” to their $5,000 charitable donation.

*This is a hypothetical example for illustration purposes only. Actual investor results will vary.

Planning Strategies

Because many clients who previously itemized will now take the larger standard deduction, reaping the tax benefits for giving to charity will now require a higher level of planning. For clients who are now taking the standard deduction who are charitably inclined, it could make sense to make larger gifts in one particular year to ensure your charitable deduction exceeds the now larger standard deduction. Or, if you’re over the age of 70 ½, the Qualified Charitable Distribution (QCD) could be a gifting strategy to explore. Of course, we would want to dig deeper into this strategy with you and your tax professional before providing any concrete recommendations.

For most of us, the number one reason we give to charity is to support a cause that is near and dear to our heart. However, as I always like to say, if we can gift in a tax efficient manner, it just means additional funds are available to share with the organizations you care deeply about instead of donating to Uncle Sam.

Don’t hesitate to reach out to us for guidance surrounding your gifting strategy, we are here to help!

Nick Defenthaler, CFP® is a CERTIFIED FINANCIAL PLANNER™ at Center for Financial Planning, Inc.® Nick works closely with Center clients and is also the Director of The Center’s Financial Planning Department. He is also a frequent contributor to the firm’s blogs and educational webinars.

Check out our other Tax Reform articles:

Changes to Federal Income Tax Brackets

Changes to Standard Deduction, Personal Exemption, Misc. Deductions, and the Child Credit

Changes to Investments and the Financial Market

Changes to State and Local Tax Deduction

Changes to Mortgage Interest Deduction (including Home Equity Loans and LOC Implications)

Changes to Estate Tax Planning in 2018 and Beyond

Changes to Medical Deductions

Changes to Business & Corporate Tax, and Pass-Through Entities

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Nick Defenthaler and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. Prior to making an investment decision, please consult with your financial advisor about your individual situation.