Standard Deduction vs. Itemizing Deductions

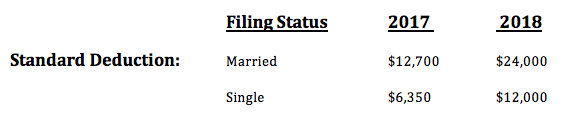

Think of the standard deduction as the “freebie deduction” that our tax code provides us, regardless of our situation. If you add up all of your eligible deductions (state and local tax, property tax, charitable donations, medical expenses, etc.) and the total happens to exceed the standard deduction, you itemize. If they fall short, then you take the standard deduction. Pretty simple, right?

With the standard deduction nearly doubling in size this year, many of us who have previously itemized deductions will no longer do so. Let’s take a look at how this change could impact the tax benefit of your charitable donations:

Example

Below is a summary of Mark and Tina’s 2017 itemized deductions*:

State and Local Taxes = $6,600

Property Tax = $6,000

Charitable Donations = $5,000

Total = $17,600

Because the standard deduction was only $12,700 for married filers in 2017, Mark and Tina itemized their deductions. However, the only reason why they were able to itemize was due to the $5,000 gift they made to charity. If they didn’t proceed with their donation, they simply would have taken the standard deduction because their state and local tax along with property tax ended up being only $12,600 – $100 shy of standard deduction for 2017 ($12,700). Their gift to charity created a tax savings for them because it went above and beyond the amount they would have received from the standard deduction!

For the sake of our example, let’s assume Mark and Tina had the same exact deductions in 2018. It will now make more sense for them to take the much larger standard deduction of $24,000 because it exceeds the total of their itemized deductions by $6,400 ($24,000 – $17,600). In this case, because they are taking the standard deduction, there was no direct “economic benefit” to their $5,000 charitable donation.

*This is a hypothetical example for illustration purposes only. Actual investor results will vary.

Planning Strategies

Because many clients who previously itemized will now take the larger standard deduction, reaping the tax benefits for giving to charity will now require a higher level of planning. For clients who are now taking the standard deduction who are charitably inclined, it could make sense to make larger gifts in one particular year to ensure your charitable deduction exceeds the now larger standard deduction. Or, if you’re over the age of 70 ½, the Qualified Charitable Distribution (QCD) could be a gifting strategy to explore. Of course, we would want to dig deeper into this strategy with you and your tax professional before providing any concrete recommendations.

For most of us, the number one reason we give to charity is to support a cause that is near and dear to our heart. However, as I always like to say, if we can gift in a tax efficient manner, it just means additional funds are available to share with the organizations you care deeply about instead of donating to Uncle Sam.

Don’t hesitate to reach out to us for guidance surrounding your gifting strategy, we are here to help!