Europe is no stranger to crisis. Not all of their crises are self-imposed, however. Popular as it may be to blame the Europeans for the current crisis, we must dig a bit deeper to get at some of the root causes of today’s problems and look more globally.

Europe is no stranger to crisis. Not all of their crises are self-imposed, however. Popular as it may be to blame the Europeans for the current crisis, we must dig a bit deeper to get at some of the root causes of today’s problems and look more globally.

In 1971, President Nixon pulled out of the Bretton Woods Accord removing the gold backing from the US Dollar (during Bretton Woods the US dollar had been pegged to the price of gold and all other currencies were pegged to the US dollar), allowing the dollar to float as it does today. This action had far-reaching consequences. Shortly thereafter, many European countries followed suit with their currencies.

Nations, including the US, started to increase their reserves by printing money in large amounts essentially decreasing the value of their currencies. Because oil was priced in US dollars, this resulted in an immediate pay cut to the oil producers. The Organization of Petroleum Exporting Countries (OPEC) eventually answered by pricing a barrel of oil against gold instead.

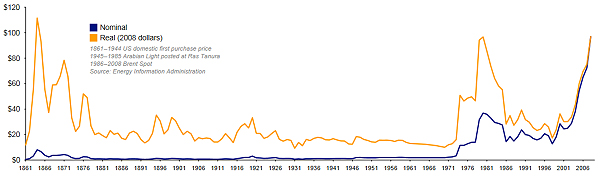

This domino effect ultimately caused the "Oil Shock" of the mid-1970s. For two decades prior, the price of oil in U.S. dollars had risen very slowly and steadily by less than two percent per year. Look at the blue (Nominal) line in the graph below, that is the oil price unadjusted for inflation. Suddenly after 1971, oil became extremely volatile and expensive.

http://en.wikipedia.org/wiki/1973_oil_crisis

http://en.wikipedia.org/wiki/1973_oil_crisis

To add insult to injury, oil exports were limited to many European nations. This led to a drastic slowdown in the European standard of living in the 1970’s causing the local governments to take on more and more debt to mitigate these effects. And so it began until the establishment of the Maastricht Treaty, which I will discuss in our next lesson.

Lesson 1: A Little History Behind the Euro Zone Crisis

Lesson 2: Who’s In the Euro Zone and Why Was It Established?

The information contained in this report does not purport to be a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and are not necessarily those of RJFS or Raymond James. Past performance may not be indicative of future results. Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.