This is the million-dollar question of recent history. There is no clear-cut answer but William James Adams PhD, professor and expert on the European economy, thinks the Euro may survive. There are two major opposing viewpoints to this question. The first is the “Anglo-Saxon View” and second is the Continental Theory.

This is the million-dollar question of recent history. There is no clear-cut answer but William James Adams PhD, professor and expert on the European economy, thinks the Euro may survive. There are two major opposing viewpoints to this question. The first is the “Anglo-Saxon View” and second is the Continental Theory.

Anglo-Saxon View

This view is based on optimal currency area theory and examines whether or not an area would benefit from a common currency. In order for a common currency to work, there must be at least one of the following tools available to the people:

- Labor mobility – Since there are major cultural differences and language barriers mobility, or the opportunity to move where the jobs are, between European countries is severely lacking for employees.

- Price and wage flexibility – Prices are very sticky, for example companies can’t just double the price of pasta because customers will simply buy something else instead.

- Transfer of tax revenues from one region to the other – This works in the U.S because the Federal government takes in $162 of tax revenue of every $100 in state tax revenue, so there is a lot to spread around as they see fit. In contrast, in Europe, the European Union only has $3 in revenue for every $100 of country revenue.

Supporters of the Anglo-Saxon view, feel that the currency has been doomed from the start.

The Continental View

When the U.S. dollar came about, none of the above scenarios were in place for almost 150 years and yet the dollar survived. This is the argument that proponents of the Continental View take.

These days, countries making a trade across borders of member nations, say from Germany to Spain, benefit greatly from the elimination of transaction costs and hedging of currency conversions that previously occurred. Also, if the Euro didn’t exist, a deflationary bias could occur, which would hurt the sale of goods. This happens when member nations start to adjust their interest rates to be more competitive and attract more investment money.

Ultimately, it is not in any country’s best interest to let the Euro collapse since they depend on exports to other European Union countries for their livelihoods. As there is no clear cut answer, it will be interesting to continue to follow the developments across the Atlantic Ocean. We are continually monitoring the situation in light of how this may impact our client’s portfolio. For more detailed information on how the Euro Zone crisis began, take a look at the other blogs in our Euro 101 series.

Please see the rest of the posts in our Euro 101 Series:

Lesson 1: A Little History Behind the Euro Zone Crisis

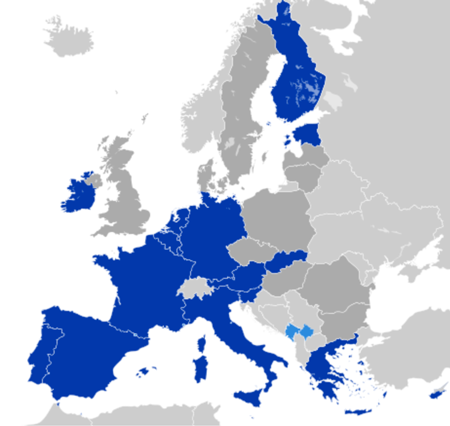

Lesson 2: Who’s in the Euro Zone and Why Was It Established?

Lesson 3: The Beginning of the End

The information contained in this report does not purport to be a complete description of the securities, markets or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.