While I was only in grade school at the time, many of you may remember the landslide victory of Ronald Reagan in 1984. He not only won 59% of the popular vote, he also had the highest number of electoral votes (525) over Walter Mondale. If you were lucky enough to be an investor at this time, you will remember this was the start of a strong bull market run for domestic stocks. But are landslide victories always this good for investors?

While I was only in grade school at the time, many of you may remember the landslide victory of Ronald Reagan in 1984. He not only won 59% of the popular vote, he also had the highest number of electoral votes (525) over Walter Mondale. If you were lucky enough to be an investor at this time, you will remember this was the start of a strong bull market run for domestic stocks. But are landslide victories always this good for investors?

The short answer is “no,” but there have not been enough landslide victories to get a good sample set to draw conclusions. The markets don’t necessarily like them because overwhelming victories by either party means the politician could have more power to invoke change and that could mean potentially higher economic policy risk resulting in higher inflation or interest rates on the horizon.

A divided government can alleviate much of this concern as it brings with it the benefits of legislative check and balances. During Reagan’s era, Democrats controlled the House while Republicans were the majority in the Senate for 6 of his 8 years as President. All parties had to work together to create the successful policies like the 25% across the board tax reduction, deregulation and corporate tax cuts that stimulated the economy and markets onward and upward.

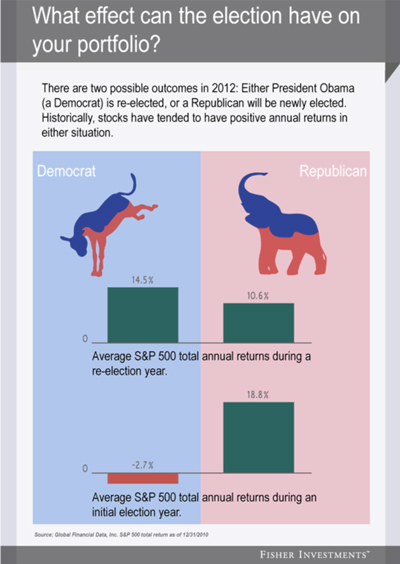

So how does this play out in the 2012 election? It may feel like the election is close, but consider that the GOP still hasn’t officially nominated a candidate. Polls tend to favor Obama against presumptive nominee Mitt Romney, but there are still four important months left of campaigning. It doesn’t appear, at this point in the race, as though a win will be a Reagan-like landslide. What it will mean for the markets remains as much of a mystery as which candidate will win on November 6th.

Source: FederatedInvestors.com

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of RJFS or Raymond James. Past performance may not be indicative of future results.