Avoid Common Inheritance Mistakes with These Tips

Contributed by: Sandra Adams, CFP®

Contributed by: Sandra Adams, CFP®

If you are like most of our clients, anticipating an inheritance likely means something is happening or has happened to someone you love. This often means dealing with the pain of grief and loss in addition to the potential stress of additional financial opportunities and responsibilities. Combining your past money experience and your relationship with the person you are losing or have lost can cause varying degrees of stress.

Approximately 15% of American adults expect to receive an inheritance in the next decade, according to the New York Life Wealth Watch survey — a shift of wealth being called the "Great Wealth Transfer." The adults who anticipate receiving an inheritance expect it from a parent, spouse, family member, or another individual. On average, adults expecting an inheritance anticipate receiving over $700,000. Only 42% of adults who expect to receive an inheritance feel very comfortable financially handling the new wealth that will be passed down to them - and nearly twice as many women who expect to receive an inheritance (23%) feel uncomfortable managing their inheritance than men who expect to receive an inheritance (12%).

The statistics are not kind. Studies show that roughly 33% of all inheritors have a negative savings balance within two years of receiving an inheritance. After five years, that number jumps to over 70%. Sadly, only about 30% of inheritors take their inheritance seriously and use it to plan for their future. It is important to be aware of and understand the typical habits of inheritors to avoid the risks.

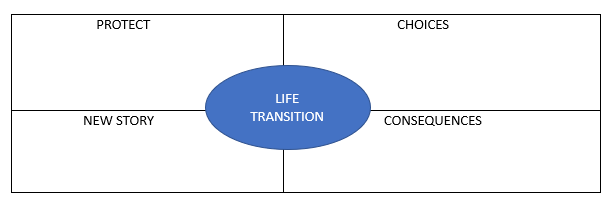

Navigating grief, discomfort with handling finances, and family dynamics can make it hard to know what to do when it comes to anticipating an inheritance. What steps can you take to ensure that you avoid the potential risks that lie ahead and use your possible inheritance to help you make the best use of any funds for your current and future financial goals?

1. Don't Rush to Make Any Big Decisions. Often, when one receives an inheritance, it is hard to resist the urge to splurge on big purchases that you haven't been able to afford in the past (a fancy new car, an exotic international vacation, etc.). A best practice is to avoid major purchases until you can take the time to do some intentional planning. We recommend taking a proactive time out from decision making (we call this a "Decision Free Zone") to process the reality of having a new financial situation and to determine how you would like that to impact your current and future financial plans, including retirement and other financial goals.

This purposeful time-out can help you avoid making promises to do things for others with the new funds. It is important that you inform others who may be expecting your financial help that you will not be ready to make those decisions for some time. This takes the stress and pressure off you and allows you time to plan what you will do with the money at your own pace. You may eventually decide to help others, including family members or charities, with some of the money if it fits in your financial plan, but by avoiding making promises right away, you don't make and/or break commitments that may lead to hurt feelings and broken relationships that could impact future relationships.

2. Set Reasonable Expectations About Timing. Once you have been informed about your inheritance, you may wonder when you will receive it. It is important to find out what types of accounts and assets you might be inheriting to set a clear expectation of how long it takes to get them.

You shouldn't expect to receive funds from an inheritance for at least one to two months following the death of a loved one (if you get them sooner, it is a pleasant surprise!) It could take longer if the assets are not liquid. In some cases, the estate is held up longer for final expenses and/or if legal issues need to be resolved.

3. Be Aware of Taxes. It is also important to be aware of the types of assets you are inheriting so that you are aware if you might owe taxes on any of the dollars you are receiving. For instance, if you are receiving funds from an IRA or an annuity contract that might have a taxable portion, and you don't have taxes withheld at the time of distribution, you might need to plan to have extra funds at tax time to pay the bill.

Setting aside a portion of the inherited dollars for any possible taxes due is a good idea so you don't get caught blindsided at tax time.

4. Consider the Details. Once you receive the assets, many other questions (besides taxes) will be answered, such as: How should I hold the assets (i.e., in what registration?) Should I hold my inherited assets separately from other assets held with my spouse? Should I hold the same investments as my grandfather/father/etc. held, or should I change the investments? If I inherited IRA assets, how long do I have to distribute the account? Getting the help of a financial adviser to answer these questions is highly recommended.

5. Work with an Advisor. Working with a financial advisor to determine what has changed or could change with your financial picture with the new inheritance is highly advisable. This could include things like:

Income

Savings/Emergency Funds

Spending

Investments

Debts/Liabilities

Health Care

Home

Insurance

Estate/Legal

Self-Care

Family/Children

Gifting/Charity

When your changes have been identified, it makes sense to determine how they can help you identify and meet your financial goals. With the help of your financial advisor, you can design a plan for how to meet your financial goals with your new inheritance. Because it can be overwhelming, we recommend determining what goals must be tackled first and what can wait until later based on a "Now…Soon…Later" schedule. Then, meet regularly with your financial advisor to begin checking off the tasks it takes to meet your goals and make the most of your inheritance.

For many, receiving an inheritance means the loss of a loved one. And the fear of failing with the big responsibility that comes with handling what is being left financially (especially if you don't feel confident handling money) might leave you feeling overwhelmed. By taking your time and using the guidance of a financial advisor who will provide you with education and guidance, you can set yourself up for success to use your inheritance to make the most of your current and future financial goals.

Sandra Adams, CFP®, is a Partner and CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® and holds a CeFT™ designation. She specializes in Elder Care Financial Planning and serves as a trusted source for national publications, including The Wall Street Journal, Research Magazine, and Journal of Financial Planning.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Sandra D. Adams, CFP® and not necessarily those of Raymond James.

Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Investment advisory services offered through Center for Financial Planning, Inc® Center for Financial Planning, Inc.® is not a registered broker/dealer and is independent of Raymond James Financial Services.