Under the Hood: Investment Allocation for 529 Savings Plans

Contributed by: Matthew E. Chope, CFP®

As many parents and grandparents know, 529 plans can be a wonderful strategy for families to help build college tuition savings for their children. Not only do the plans benefit students, but they also carry advantages for the account creators or donors. The student can potentially enjoy tax-deferred growth with federally tax-free distributions if used for qualified educational expenses. Advantages to the donor include complete control of the account, high contribution limits, and no age restrictions or income limitations to inhibit investing. It’s no surprise that 529 savings plans have become popular savings vehicles.

Have you ever wondered how 529 college savings plans are invested to meet time-sensitive tuition expenses?

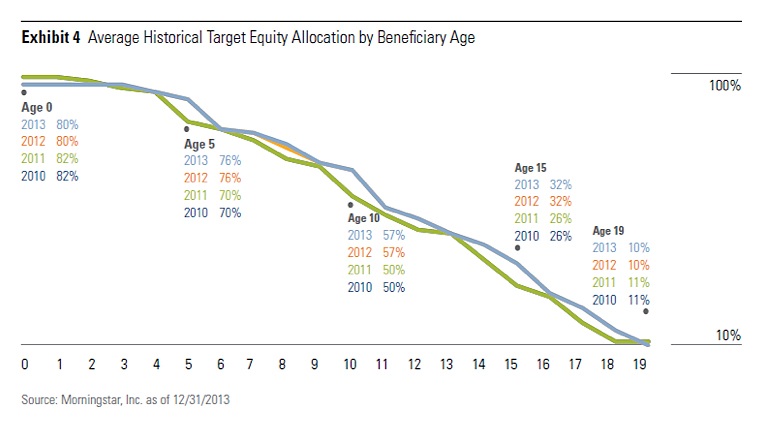

Age-based investment funds make this challenge easily manageable. The graph below shows the glide path of equity allocations for 529 savings plans at various ages of the beneficiary from 2010 to 2013.

Generally, 80% of the portfolio is invested in equities at age 0 and reduces to 10% by the time the beneficiary is enrolled in college.

Since 2010, plan investment managers have become more conservative in the beginning (age 0) and end (age 19) stages of plans.

Investment managers have become 6-7% more equity aggressive during ages 5-15 to meet tuition goals.

To meet tuition needs within 18 years, the graph reveals that investment managers are becoming more aggressive during the middle of a student’s investment time horizon, but they are also growing more cautious about preserving money closer to the end of the student’s investment time frame. Interestingly, the graph also reveals that investment managers still rely on bonds as one of the safest places to preserve money (90% of the portfolio by age 19), despite the negative reputation bonds have received in our current rising rate environment.

The glide path is designed to allow for an outcome with minimal surprises to all investors, no matter the economic environment when it’s time for college. Some cycles will end on a poor note with markets crashing, while in other times markets will be soaring as students begin to tap the funds. Ultimately, the guide path is designed to gradually reduce investors’ risk and exposure to market disruptions in the final years of saving, when investors are closest to needing the money they’ve worked so hard to save.

Investors should carefully consider the investment objectives, risks, charges and expenses associated with 529 plans before investing. This and other information about 529 plans is available in the issuer's official statement and should be read carefully before investing. Investors should consult a tax advisor about any state tax consequences of an investment in a 529 plan.

As with other investments, there are generally fees and expenses associated with participation in a 529 plan. There is also a risk that these plans may lose money or not perform well enough to cover college costs as anticipated. Most states offer their own 529 programs, which may provide advantages and benefits exclusively for their residents. The tax implications can vary significantly from state to state.

Matthew E. Chope, CFP ® is a Partner and Financial Planner at Center for Financial Planning, Inc.® Matt has been quoted in various investment professional newspapers and magazines. He is active in the community and his profession and helps local corporations and nonprofits in the areas of strategic planning and money and business management decisions.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of the author and are not necessarily those of Raymond James.