How To Invest Your Money In Turbulent Markets

Contributed by: Jaclyn Jackson, CAP®

Contributed by: Jaclyn Jackson, CAP®

Navigating daily market fluctuations through COVID-19 has been challenging. With every newsfeed from Washington or new economic data numbers, markets react. So what do we make of this as investors? Well, it truly depends on your circumstance. For individuals who have a long investment horizon and stable finances, there may be an opportunity to take advantage of market inefficiencies.

For individuals who have experienced (or anticipate) financial changes, it may be time to reevaluate your investment approach. Here are a few ideas to discuss with your advisor when considering investment strategies during the coronavirus pandemic.

Strategies for Long-Term Investors

For long-term investors, volatile markets should not discourage commitment to your investment plan. Staying invested, reestablishing your asset allocation, gradually investing, and generating tax opportunities are still valuable to progressing your investment aims. Think about the following strategies:

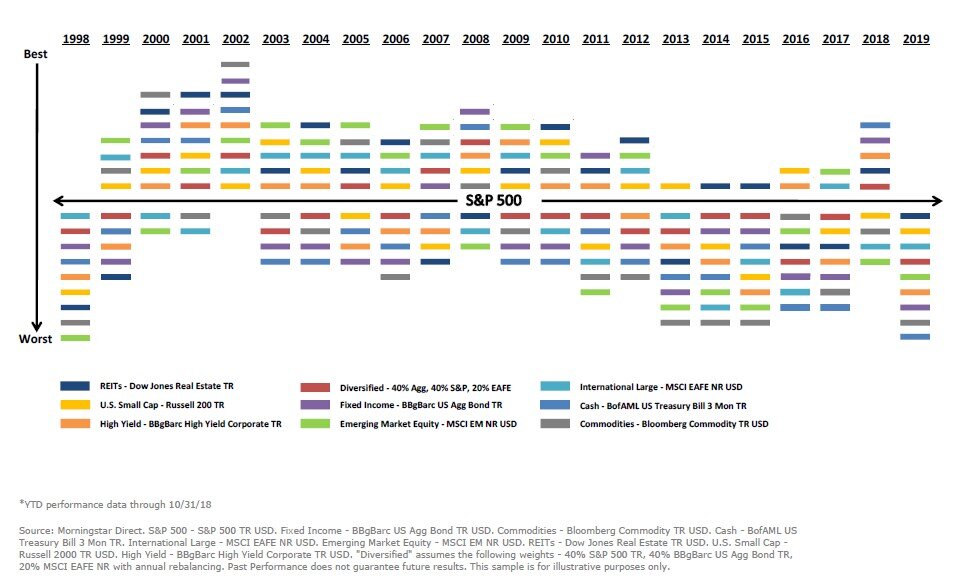

Rebalance - Rebalancing is a systematic way of adapting the commonly suggested investment advice, “buy low and sell high”. It disciplines investors to trim well-performing investments and buy investments that have the potential to gain profits. In our current environment, that looks like trimming from bond positions and investing in equities for many people. Importantly, rebalancing helps investors maintain their established asset allocation; someone’s predetermined investment allocation suited to meet their investment objectives. In other words, rebalancing helps investors maintain the risk/return profile meant to enhance their probability of meeting long-term goals.

Dollar-Cost Average - A gingerly alternative to rebalancing is dollar-cost averaging. Investors who use this strategy identify underexposed asset classes and invest a set amount of money into those assets at a set time (i.e. monthly) over a set period (i.e. 1 year). This method helps investors buy more shares of something when it is inexpensive and fewer shares of something when it is expensive. Buying at a premium when the market is up is stabilized by taking advantage of prices when the market is down. Therefore, the average cost paid per share of your investment is cheaper than just paying the premium prices. Having a dollar-cost averaging strategy in place now, while markets have dipped, helps you buy more shares of investments while they cost less.

Tax Loss Harvest - Selling all or part of a position in your taxable account when it is worth less than what you initially paid for it creates a realized capital loss. Losses can offset capital gains and other income in the year you realize it. If realized losses exceed realized gains during that year, realized losses can be carried forward (into future years). Harvesting losses could help investors replace legacy positions, diversify away from concentrated positions, or stow away losses for more profitable times.

Do Nothing - The key here is to stay invested. The challenge with fleeing investment markets when they are down is that it is incredibly hard to time reinvesting when they will go back up. Missing upside days may inhibit full recovery of losses. According to research developed by Calamos Investments, missing the 20 best days of the S&P 500 over 20 years (1/1/99 – 12/31/19) reduced investment returns by two-thirds. Time, not market timing, supports you in meeting your investment goals.

Strategies Amid Financial Hardships

Many people’s employment and financial situations have changed. Understandably, some have to review their ability to invest. If you are concerned about losing your job or potential health issues, it is time to revisit your savings. Could your rainy day resources cover 6-8 months of financial needs? If not, you will likely need to build up savings. For those who are experiencing financial challenges, consider the following strategies:

Add to emergency funds by lowering or pausing retirement account contributions. Luckily, you do not have to liquidate part of your retirement account with this strategy. Staying invested gives your portfolio a chance to benefit from long-term performance. If your employer matches retirement account contributions, continue to invest up to that amount, then add to savings with the balance of your normal participation amount. Once savings needs are met, resume full investment participation.

Rebalance your portfolio to provide liquidity. As noted above, rebalancing takes earnings off the table from investments that have performed well. However, instead of reallocating to other investments, use proceeds to increase your rainy day savings. This method prevents you from selling off positions that are at a loss.

Jaclyn Jackson, CAP® is a Portfolio Administrator at Center for Financial Planning, Inc.® She manages client portfolios and performs investment research.

Please note, the options noted above are not for everyone. Consult your advisor to determine which options are appropriate for you. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Diversification and asset allocation do not ensure a profit or protect against a loss. Rebalancing a non-retirement account could be a taxable event that may increase your tax liability. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.