Contributed by: Josh Bitel, CFP®

Contributed by: Josh Bitel, CFP®

May is Mental Health Awareness Month, and as we all know, managing stress can go a long way in improving mental health. Personally, I have always been a bit of a “worry wart” and often have to remind myself not to sweat the small stuff and focus on what I can control. And of course, as a financial planner, I find this very easy to relate to investing and saving for retirement! Below is a graphic from J.P. Morgan that I have shared many times with clients. Just as we try to do in our personal lives, managing what we can control and not worrying about other factors can go a long way in relieving some of the stress that comes with saving for retirement.

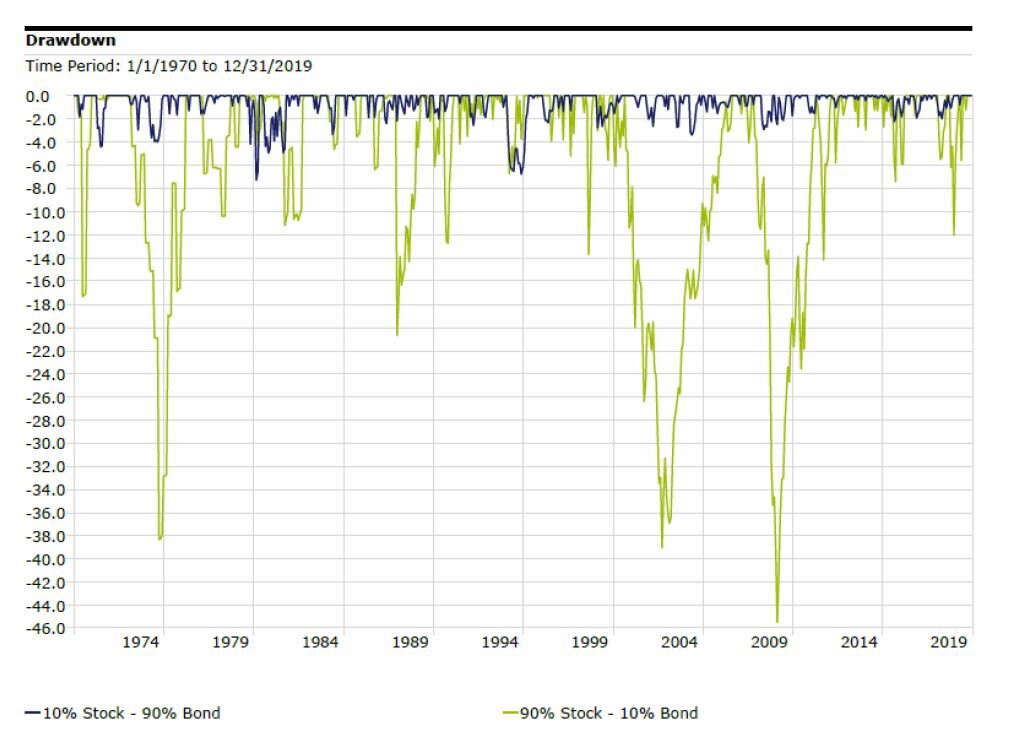

The major area that we as investors often become fixated on (and rightfully so!) is market returns. Ironically, as the chart shows, this is an area we have no control over. The same goes for policies surrounding taxation, savings, and benefits. As you can see, employment and longevity are things we do have some control over by investing in our own human capital and our health. In my opinion, the areas that we have total control over—saving vs. spending and asset allocation and location—are what we need to focus on. We try to have clients focus on consistent and prudent saving, living within (or ideally, below) their means, and maintaining a proper mix of stocks and bonds within their portfolio. Over the course of 35+ years of helping clients achieve their financial goals, The Center has realized that those two areas are the largest contributors to a successful financial plan.

With so many uncertainties in the world we live in that can impact the market, it is always a timely reminder to focus on the areas we have control over and make sure we get those right. If we do, the other things that we might be stressing over will potentially fall into place. If you need help focusing on the areas of your financial well-being that you CAN control, give us a call! We are always happy to help.

Josh Bitel, CFP® is a CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® He conducts financial planning analysis for clients and has a special interest in retirement income analysis.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Josh Bitel, CFP® and not necessarily those of Raymond James.

and

and