Have You Prepared Your Advocates?

Contributed by: Sandra Adams, CFP®

Contributed by: Sandra Adams, CFP®

Going through the process of completing your estate planning documents is not an easy process. Working with an attorney to determine what documents you need, how you want the language written so that your assets are handled and decisions are made the way YOU want them, and choosing the best advocates to carry out those instructions can be very involved. No wonder it is a task that many people put off doing – it can be overwhelming!

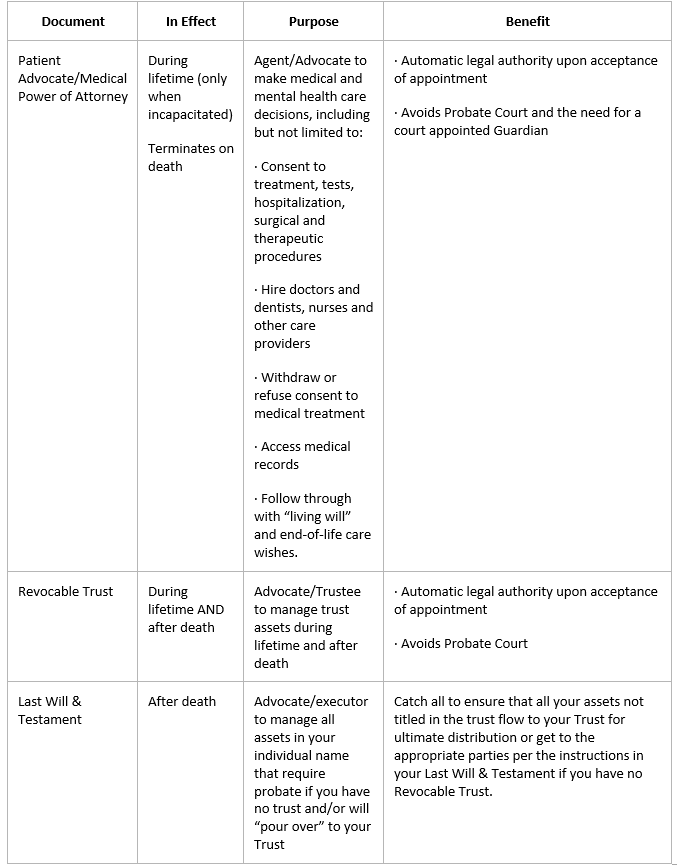

Common Documents With Named Advocates

The most common estate planning documents that individuals have drafted (and that will require advocates to be named) are the following:

Most clients are so relieved when their documents have been drafted; it is a huge weight off their shoulders to have so many important decisions made and in place. It feels satisfying to have the binder of documents drafted by the attorney in hand and completed.

Perhaps if you are even more “on the ball,” you follow through and get copies of your documents to your financial advisor and update your asset titling and beneficiaries according to the funding instructions provided by the attorney. If you have done that, you are ahead of the majority of clients, most of whom take the big binder home and file it away in a safe place and consider their estate planning completed! But is it?

Have you taken the final step and communicated to those you have chosen as your advocates that you have named them in your documents?

The Importance of Communicating With Your Advocates

It is not uncommon for people to name others as future advocates for them in their legal documents, but not to communicate to them that they have been named. If you’ve ever been in the shoes of being that named advocate, and getting that “surprise” call that you suddenly need to make a life and death decision about someone’s health treatment when you had no idea you were named as their health care advocate and had not had conversations with them regarding their wishes around end of life treatment, you might think differently about having those proactive conversations.

It is extremely important to take this last step, and not only communicate with your advocates that they have been named in your documents but also give them the key information that they will need to fulfill your wishes.

Here is the key information you need to share:

Patient Advocate/Health Care Advocate:

Drug allergies

Current medications (or where to find your medications list)

Your primary providers, your wishes on Code Status (i.e. DNR or full Code), and where your estate planning documents are located

Your past surgical history

Whether or not there is metal anywhere on your body

What your wishes are for end-of-life care and treatments (i.e. aggressive vs. comfort treatment)

Plans for future care and any professional relationships and resources that can be used to assist the advocate in their role (social workers, Geriatric Care Managers, etc.)

Durable Power of Attorney/Successor Trustee:

Contact information for your professional advisors and, if possible, an introduction to those professionals.

Instructions on where to find an “open me first” document (ex. Personal Financial Record System) that details your financial life (bank accounts, investment accounts, insurance policies, government benefits, employer benefits, etc.)

Where to find your estate planning documents and a review of your Trust (especially for your successor Trustee, so they have a heads-up on how they might be managing your assets)

An overview/general conversation about your wishes regarding handling your assets for future care and your values around money.

Executor/Advocate:

Contact information for your professional advisors and, if possible, an introduction to those professionals.

Instructions on where to find an “open me first” document (ex. Personal Financial Record System) that details your financial life (bank accounts, investment accounts, insurance policies, government benefits, employer benefits, etc.)

Instructions on where to find your Letter of Last Instruction document outlining your wishes for after death.

Where to find your estate planning documents, especially your Last Will & Testament, which will be the guiding document for your Executor.

An overview/general conversation about your wishes regarding after-death arrangements, about your Will, and how you would like your assets handled post-death, especially if there is no Trust for assets to flow to.

The more information you can share with your future advocates, the better prepared they will be to make the decisions you would want them to make on your behalf should they ever need to serve. An advocate’s job is to be your fiduciary, which means to make decisions in your best interest; without the benefit of having full information on you and your situation, you make it almost impossible for them to do their job to the best of their ability.

If you have taken the time to draft your estate planning documents, our best advice is to complete the process by fully preparing your advocates to serve in your best interest – they’ll be glad you did!

Sandra Adams, CFP®, is a Partner and CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® and holds a CeFT™ designation. She specializes in Elder Care Financial Planning and serves as a trusted source for national publications, including The Wall Street Journal, Research Magazine, and Journal of Financial Planning.

Opinions expressed in the attached article are those of Sandra D. Adams, CFP® and are not necessarily those of Raymond James. Securities Offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Investment advisory services offered through Center for Financial Planning, Inc. Center for Financial Planning, Inc., is not a registered broker/dealer and is independent of Raymond James Financial Services.