Markets and the economy are still riding the high of greater than expected fiscal stimulus at the beginning the year, an easy Federal Reserve, and economic re-opening. Generally speaking, when economies are expected to do well, stock prices will rise and bond yields are pressured upward which pushes current bond prices down. 2021 is following that pattern. Stock markets around the world continue to climb, and bond yields here in the U.S. are rising as well. To put performance in context, we look at a simple diversified portfolio benchmark consisting of 60% stocks (split between U.S.-S&P 500 and International-MSCI EAFE) and 40% bonds (Bloomberg Barclays U.S. Aggregate Bond Index). This benchmark portfolio is up just over 7% year-to-date as of June 30th, with the S&P 500 leading the way at +15.2%, international stocks (MSCI EAFE) at +9%, and U.S. Aggregate Bonds at a quiet -1.6%.

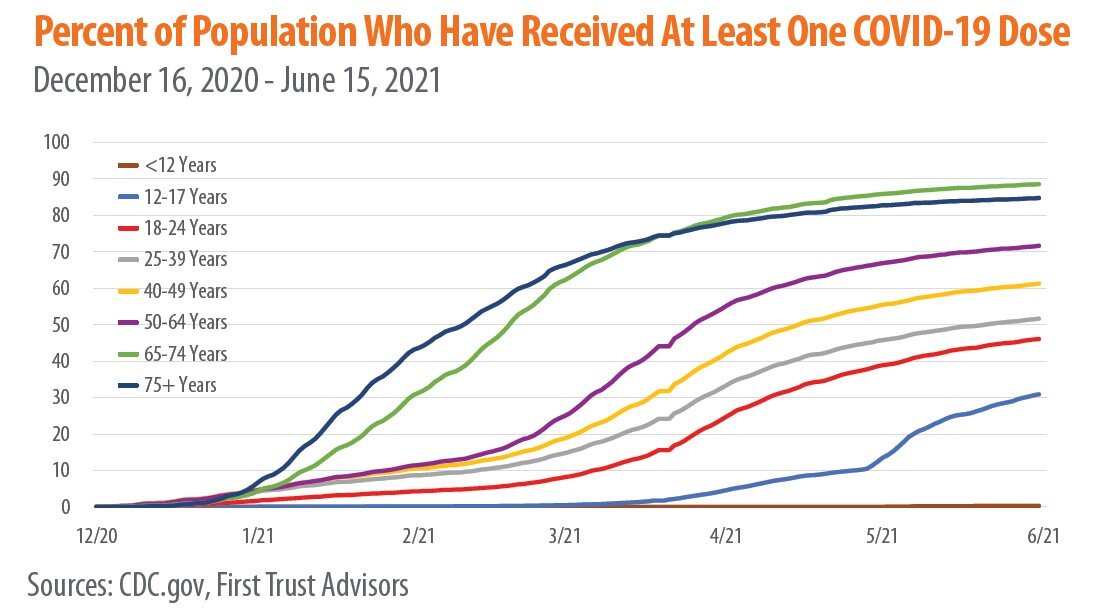

Gross Domestic Product has shown a sharp increase this year as well as inflation readings heating up (see our recent blog for more information). Many American’s have received at least 1 dose of a COVID vaccine with high vaccination rates among our most vulnerable population 65+. Over 80% of those individuals have received a vaccination. Now that the 12 - 16 year old community can receive a vaccination we are only awaiting an approval of a vaccine for younger children. It is likely we will see something later this year.

Federal Reserve (The Fed) Policy updates

Short term rates were left unchanged as expected and the monthly pace of asset purchases by the Federal Open Market Committee is unchanged. Market expectations of future interest rate movements rely strongly on the “dot plot” which is a summary of individual projections of year-end target rates for each of the 18 senior Fed officials (even though not all of them get a vote). Based on this, news headlines are suggesting the Fed is now targeting two rate increase by the end of the 2023. When asked, Chairman Powell stated, “dots need to be taken with a big grain of salt.” So it looks like the Fed maintains their outlook of keeping rates low through the end of 2023 but that the bond market may be pricing in rate hikes earlier than this.

Jobs

The Fed also notes labor force participation rates are lagging as evidenced by more job openings then people unemployed.

Source: Bureau of Labor Statistics

This is, likely, still driven by pandemic-related issues like caregiver needs, ongoing fear of the virus and supplemental/extended unemployment insurance benefits. As these abate we should see people returning to the workforce and the bottleneck in unemployment alleviated. Additional government unemployment benefits were set to expire in 25 states at the end of June and the remainder of states by the end of September. This should result in individuals returning to the labor force especially in the lower wage jobs. We will be closely watching this to see if upward wage pressure is alleviated as people resume work. If not, this could indicate a structural lack of labor participants and be a larger than expected driver of inflation.

Real Estate

The real estate sector benefits from the rising value of assets with rising rates as well as inflation-linked product prices and leases. From a market standpoint, individual company level investments offer opportunity. In other words, the sector currently favors stock pickers. Investors who think inflation will be strong in the coming years target companies with properties that have shorter leases. While anticipation for government-backed projects in the near future spotlight infrastructure companies. However, what to buy is not what challenges investors when it comes to this sector. The true challenge is understanding when to buy this sector. For that reason, many experts like Michelle Butler, real assets portfolio specialist at Cohen & Steers, recommend having an ongoing real asset portfolio allocation to provide protection against unexpected inflation.

From a political standpoint, our eyes are poised on Joe Biden’s American Families Plan and the implications it may have on real estate. According to white house briefings, the American Families plan is “$1.8 trillion in investments and tax credits for American families and children over ten years. It consists of about $1 trillion in investments and $800 billion in tax cuts for American families and workers”. One of the proposed ways of funding the plan is changing favorable tax treatment on 1031 exchanges. Traditionally, 1031 exchanges (like-kind exchanges) allow investors to defer real estate taxes by rolling profits into their next property purchase. The new tax proposal seeks to remove tax deferments on property gains over $500,000. While meant to largely impact the wealthiest of investors, some experts fear the proposal could also have a negative effect on small business owners. Please note, these are just proposals and not legislation that has been introduced or passed at this point. We are watching to see how this plays out.

Additional notes on inflation:

If inflation is less transitory and more persistent than expected it is important to understand the areas we think about leaning toward in portfolio construction. Real Assets, Value stocks and active management within your bond portfolio to take advantage of areas like treasury inflation protection bonds can be very important. Read all the way to the end of the above linked inflation blog to see what other asset classes might fare well in a low and rising inflationary environment.

Crypto Crash 2021

This isn’t the first time cryptocurrency has lost a majority of its value in a flash crash, and it won’t be the last. In 2012, 2015, and 2019 it fell more than EIGHTY PERCENT from its previous high. At $32,000 Bitcoin is currently about 50% off its previous high. Fun math check – in order to reach an 80% drawdown from its previous high, it would have to fall ANOTHER 60% from here. In an aggressive portfolio actively managed cryptocurrency can generate market crushing returns (or losses) depending on time of purchase and an investors ability to be disciplined in their selling strategy. Look out for a blog in the coming months for more on cryptocurrency trading, speculation, blockchain technology, and threats to the crypto industry.

Here are a few ESG investment focused recent additions to our website to check out:

ESG Investing: Why Everybody Is Talking About It

Not All ESG Funds Are Created Equal

The Center Social Strategy: How We Construct Values-Based Portfolios

As always, don’t hesitate to reach out to us if you have any questions or would like to explore any of these topics further! We appreciate the continued trust you place in us!

Angela Palacios, CFP®, AIF®, is a partner and Director of Investments at Center for Financial Planning, Inc.® She chairs The Center Investment Committee and pens a quarterly Investment Commentary.

Jaclyn Jackson, CAP® is a Portfolio Manager at Center for Financial Planning, Inc.® She manages client portfolios and performs investment research.

Nicholas Boguth is a Portfolio Administrator at Center for Financial Planning, Inc.® He performs investment research and assists with the management of client portfolios.

Opinions expressed are those of the author and are not necessarily those of Raymond James. All opinions are as of his date and are subject to change without notice. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The MSCI EAFE (Europe, Ausrtalasia, and Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 22 developed nations. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Keep in mind that individuals cannot invest directly in any index, and index performances does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past performance does not guarantee future results. Bitcoin issuers are not registered with the SEC, and the bitcoin marketplace is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involves a high degree of risk.