Contributed by: Kali Hassinger, CFP®

Contributed by: Kali Hassinger, CFP®

Some of you may be familiar with the blanket term "stock options." In the past, this term most likely referred to Employee Stock Options (ESOs), which were frequently offered as an employee benefit and form of compensation. But over time, employers have adapted stock options to better benefit both their employees and themselves.

ESOs provided the employee the right to buy a certain number of company shares at a predetermined price, for a specific period of time. These options, however, would lose their value if the stock price dropped below the predetermined price, making them essentially worthless to the employee.

Shares promised

As an alternative, many employers now use another type of stock option, known as Restricted Stock Units (RSUs). Referred to as a "full value stock grant,” RSUs are worth the "full value" of the stock shares when the grant vests. So unlike ESOs, the RSU will always have value to the employee upon vesting (assuming the stock price doesn't reach $0). In this sense, the RSU is a greater advantage to the employee than the ESO.

As opposed to some other types of stock options, the employer does not transfer stock ownership or allocate any outstanding stock to the employee until the predetermined RSU vesting date. The shares granted with RSUs essentially become a promise between the employer and employee, but the employee receives no shares until vesting.

RSU tax implications

Since there is no "constructive receipt" (IRS term!) of the shares, the benefit is not taxed until vesting.

For example, if an employer grants 5,000 shares of company stock to an employee as an RSU, the employee won't be sure of how much the grant is worth until vesting. If this stock value is $25 upon vesting, the employee would have $125,000 of income (reported on their W-2) that year.

As you can imagine, vesting dates may cause a large jump in taxable income, so the employee may have to select how to withhold taxes. Usual options include paying cash, selling or holding back shares within the grant to cover taxes, or selling all shares and withholding cash from the proceeds.

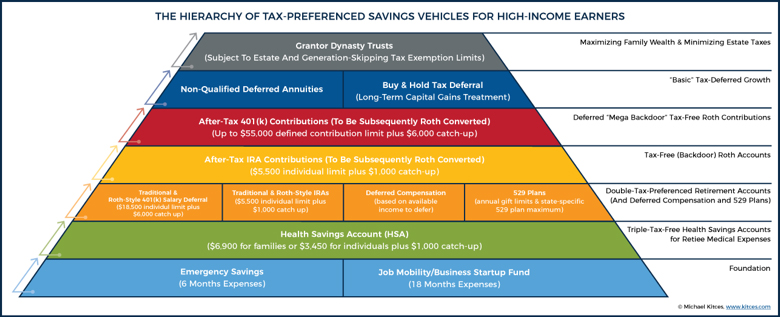

In some RSU plan structures, the employee may defer receipt of the shares after vesting, in order to avoid income taxes during high earning years. In most cases, however, the employee will still have to pay Social Security and Medicare taxes in the year the grant vests.

Although there are a few differences between the old-school stock options and more recent Restricted Stock Unit benefit, both can provide the same incentive for employees. If you have any questions about your own stock options, we’re always here to help!

Repurposed from this 2016 blog: Restricted Stock Units vs Employee Stock Options

Kali Hassinger, CFP® is an Associate Financial Planner at Center for Financial Planning, Inc.®

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Kali Hassinger, CFP® and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Investments mentioned may not be suitable for all investors. This is a hypothetical example for illustration purpose only and does not represent an actual investment.