Contributed by: Angela Palacios, CFP®, AIF®

Contributed by: Angela Palacios, CFP®, AIF®

Inflation is common in developed economies and is generally healthier than deflation. When consumers expect prices to rise, they purchase goods and services now rather than waiting until later. Inflation has continued to trend higher here in the U.S. over the past year, and many are now asking, "Can this harm my portfolio's ability to help me achieve my goals?" Consider the following factors contributing to or detracting from the inflation outlook.

Our investment committee has discussed inflation at length for several years now. Here are some highlights from our discussion.

Factors influencing inflation in the short term and long term:

1. Large amount of monetary and fiscal stimulus

There has been a record amount of stimulus being pushed into the pockets of Americans by the government. The consumer is healthier than it has ever been and demanding to purchase.

2. Supply chain disruptions

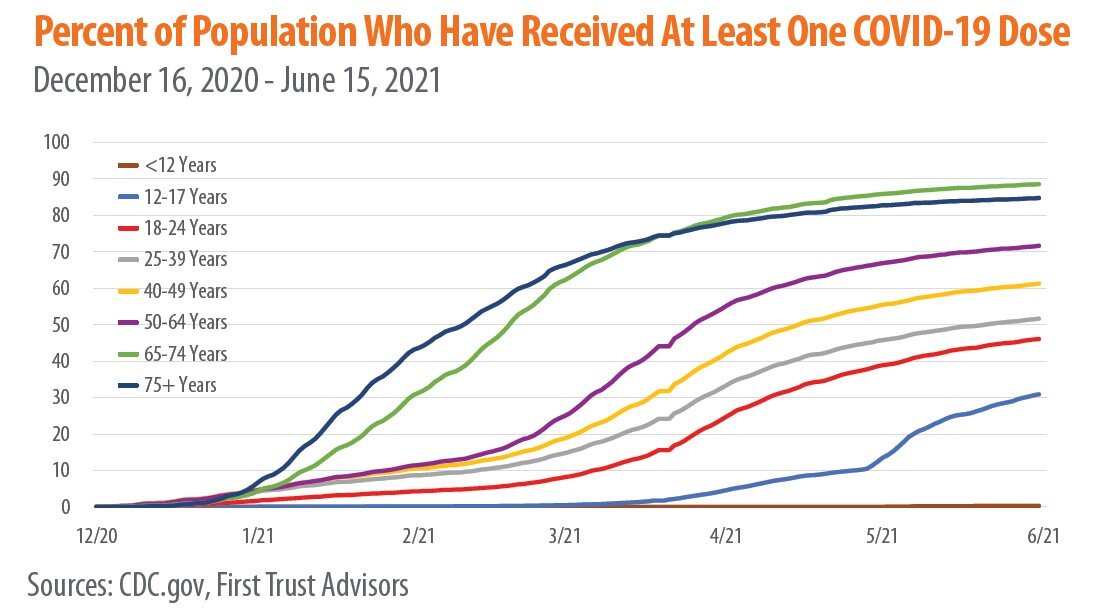

Due to shipping constraints or lack of manpower, companies can't make enough of many different products to meet current demand. Does this sound familiar? It should; because two years ago, all we could talk about was not having enough toilet paper and disinfectant wipes. People were paying high prices for even small bottles of hand sanitizer. Fast forward two years and the shelves are now overflowing with these items as prices have normalized. Once people have spent the money they accumulated over the past two years and can purchase the goods and services they want when they want to, demand will likely return to normal.

3. Starting from a very low base

The point to which we are comparing current inflation is one of the biggest influences on the calculation. For year over year inflation, we were comparing to an economy that had very little to no economic activity occurring and was still digging out of the hole the pandemic created. When you compare something to nothing, it looks much larger than it is. Now we are starting to compare to a more normalized time, so we should see this number trend downward simply because of this anomaly.

4. Wage inflation

One of the biggest factors in the lack of inflation over the past decade was a lack of wage inflation. We are now seeing wage inflation because companies can't hire enough people to meet the current demand for their goods or services. Wages are going up trying to entice people back to work. For many years, no wage inflation at lower-paying jobs has culminated in a resetting of wages recently (it is likely wages settle at a higher base than they were before, but it doesn't mean they will continue to rise at the pace they have been).

5. A complete lack of velocity of money

While banks are flush with cash, they still aren't lending. Why? Because the banks, due to banking regulation changes over ten years ago, only want to loan large amounts of money to someone who is creditworthy. Creditworthy consumers are so healthy that they don't need to borrow money.

6. Technology increasing productivity

A large portion of the country increased productivity by reducing commute time via remote working capabilities over the past two years. Companies that would never have considered allowing remote work now find themselves reducing office space and making permanent shifts in working style. This is just one example of how growth in technology can increase productivity which, over time, puts downward pressure on prices. The Center is an excellent example of this. While our team is back in the office, we work a hybrid schedule of several days in the office and several days remotely.

It is important to understand what investments could do well if we are surprised and inflation is around the corner.

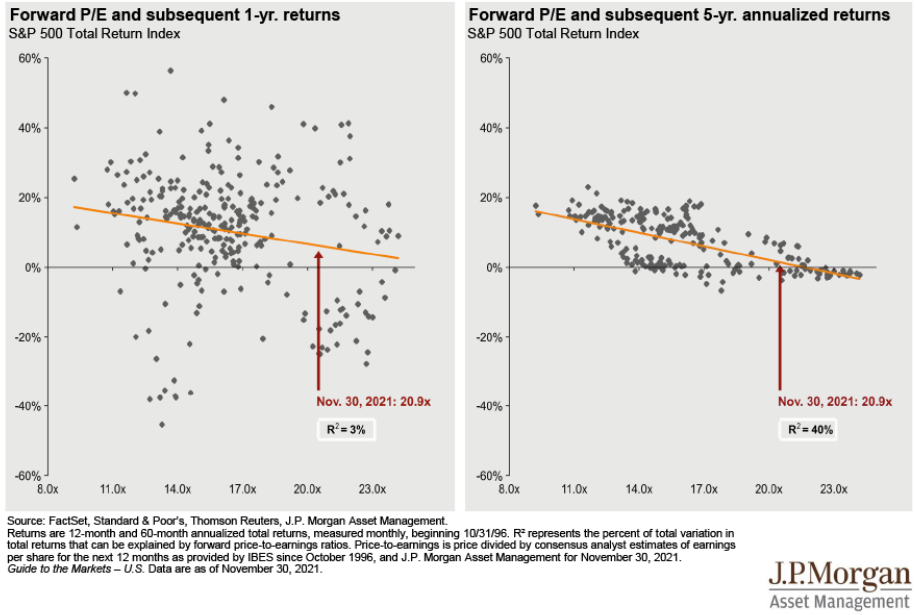

First of all, your starting point is very important. Are you starting from low inflation, or are your inflation levels already elevated? The answer is we are starting from a long stretch of time with very low inflation rates. So in the chart below, you would reference the lower two boxes. Then it would be best if you asked, "Is inflation rising or falling?” Low and rising inflation is in the bottom left box. You may be surprised to see the strong, average performance from varying asset classes in this scenario. Inflation that is reasonable and expected can be a very positive scenario for many asset classes.

The past year had inflation prints that many investors saw as unreasonable and unexpected. Stocks and bonds struggled because of inflationary pressures. If inflation starts to moderate, as I think it will, fear should start to diminish. In the meantime, commodity-linked sectors and countries benefitted through positions held in portfolios like real asset holdings. Diversification remains important!

Inflation assumptions are fundamental in the financial planning process. This is why it's important that we utilize Monte Carlo simulations, meaning we plan for some pretty bad scenarios in the planning process. If you would like to gather more insight or an update on your plan, don't hesitate to give us a call!

Angela Palacios, CFP®, AIF®, is a partner and Director of Investments at Center for Financial Planning, Inc.® She chairs The Center Investment Committee and pens a quarterly Investment Commentary.

The information contained in this letter does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Angela Palacios CFP® AIF®, and not necessarily those of Raymond James. Expression of opinion are as of this date and are subject to change without notice. There is no guarantee that these statement, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Individual investor’s results will vary. Past performance does not guarantee future results. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Rebalancing a non-retirement account could be a taxable event that may increase your tax liability.